Shopify tax calculation

Use this form to request a free fully-functional trial to. Shopify recently updated their default sales tax collection for California as of April 2020.

How To Charge Shopify Sales Tax On Your Store Sep 2022

Prior to April 2020 Shopifys automatic tax collection service defaulted to calculating tax rates in.

. For this we would like to calculate taxes. Keep more profit while reducing risk and stress. Sales Tax Automation with AccurateTax.

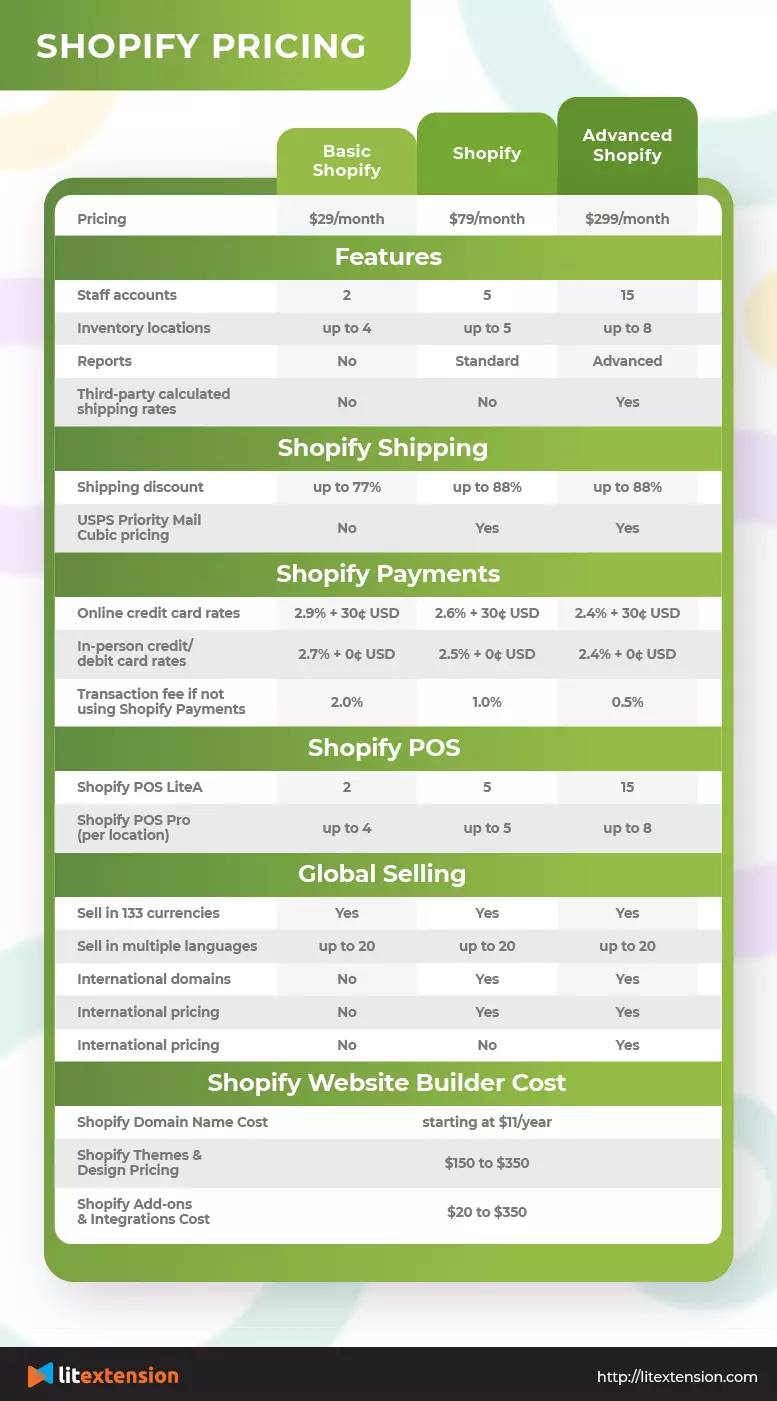

CCS is included with Advanced Shopify or higher. Ad Maximize your potential and grow your business with unlimited capital aligned to your plan. Your household income location filing status and number of personal exemptions.

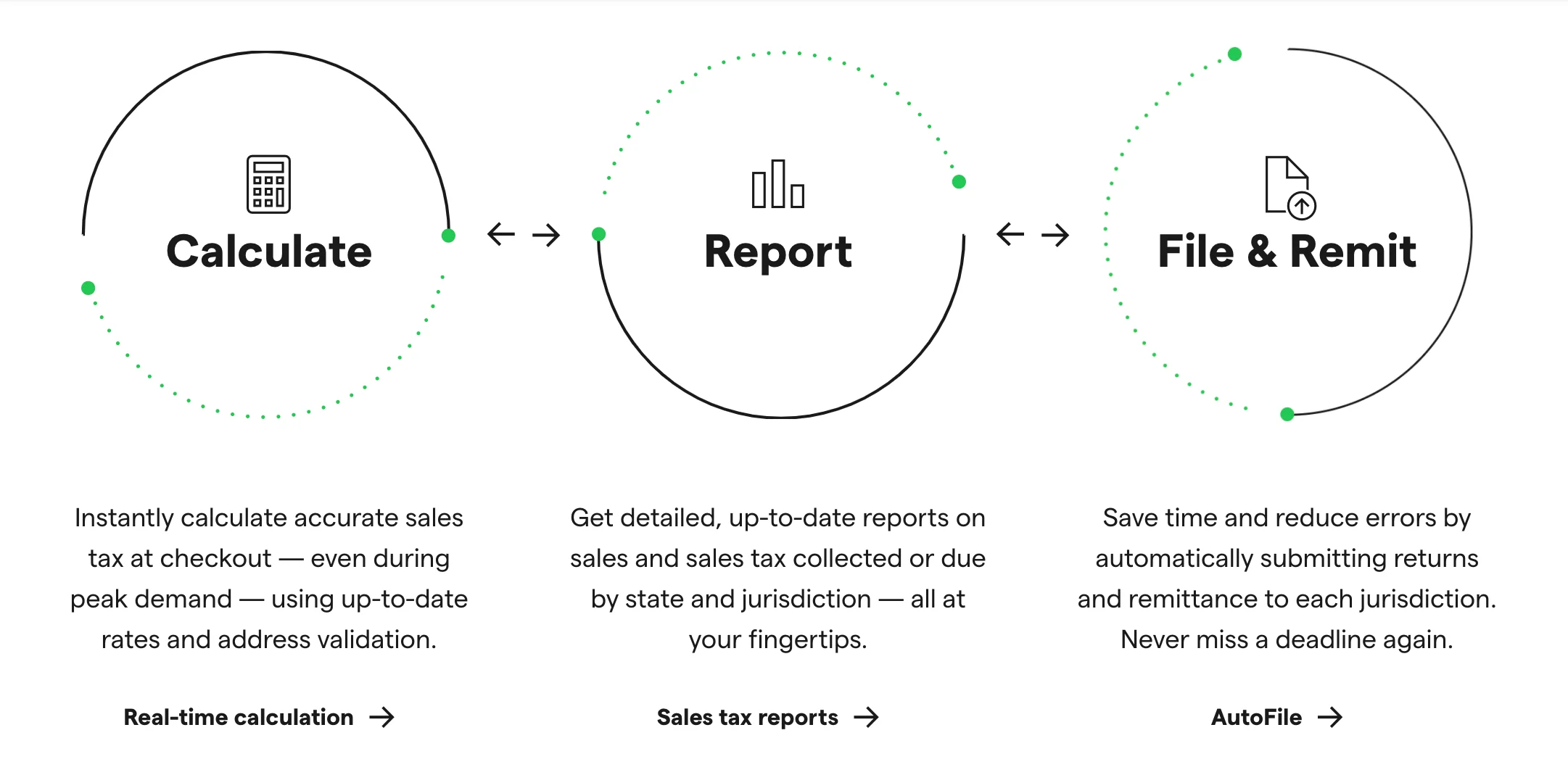

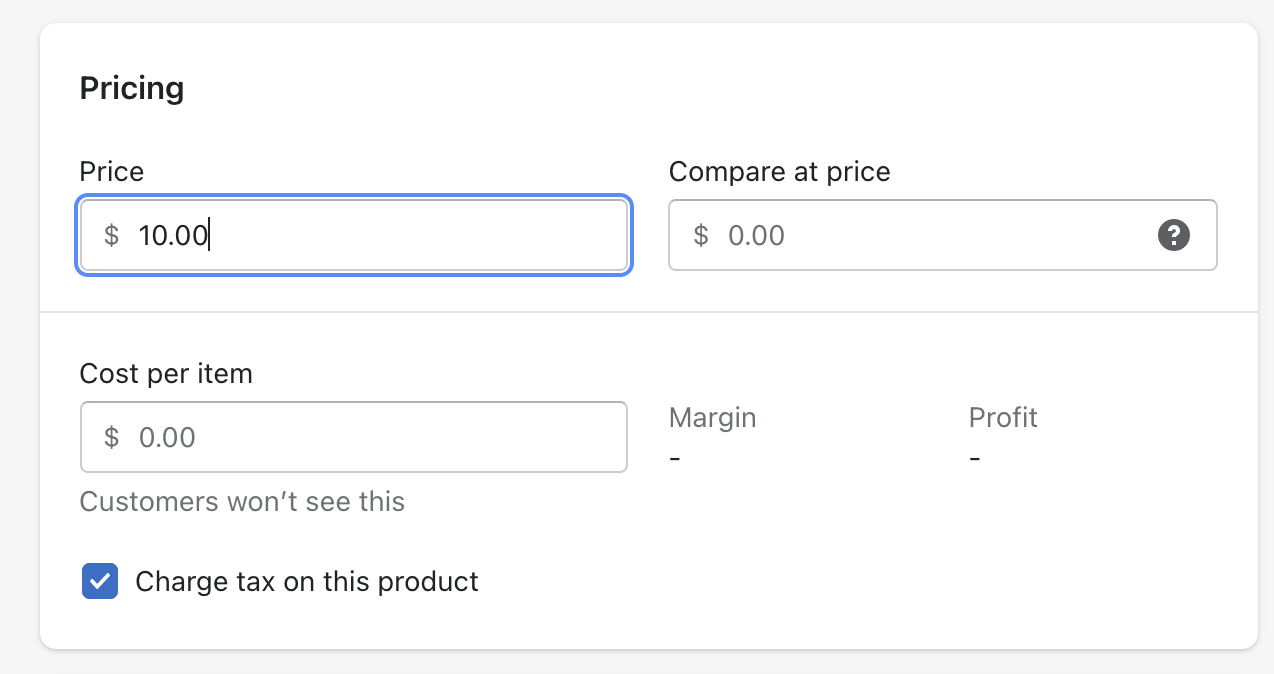

Lets plan your success. Shopify comes out-of-the-box with tax rates for different regions. As a Shopify business owner we help you automatically handle most tax calculations.

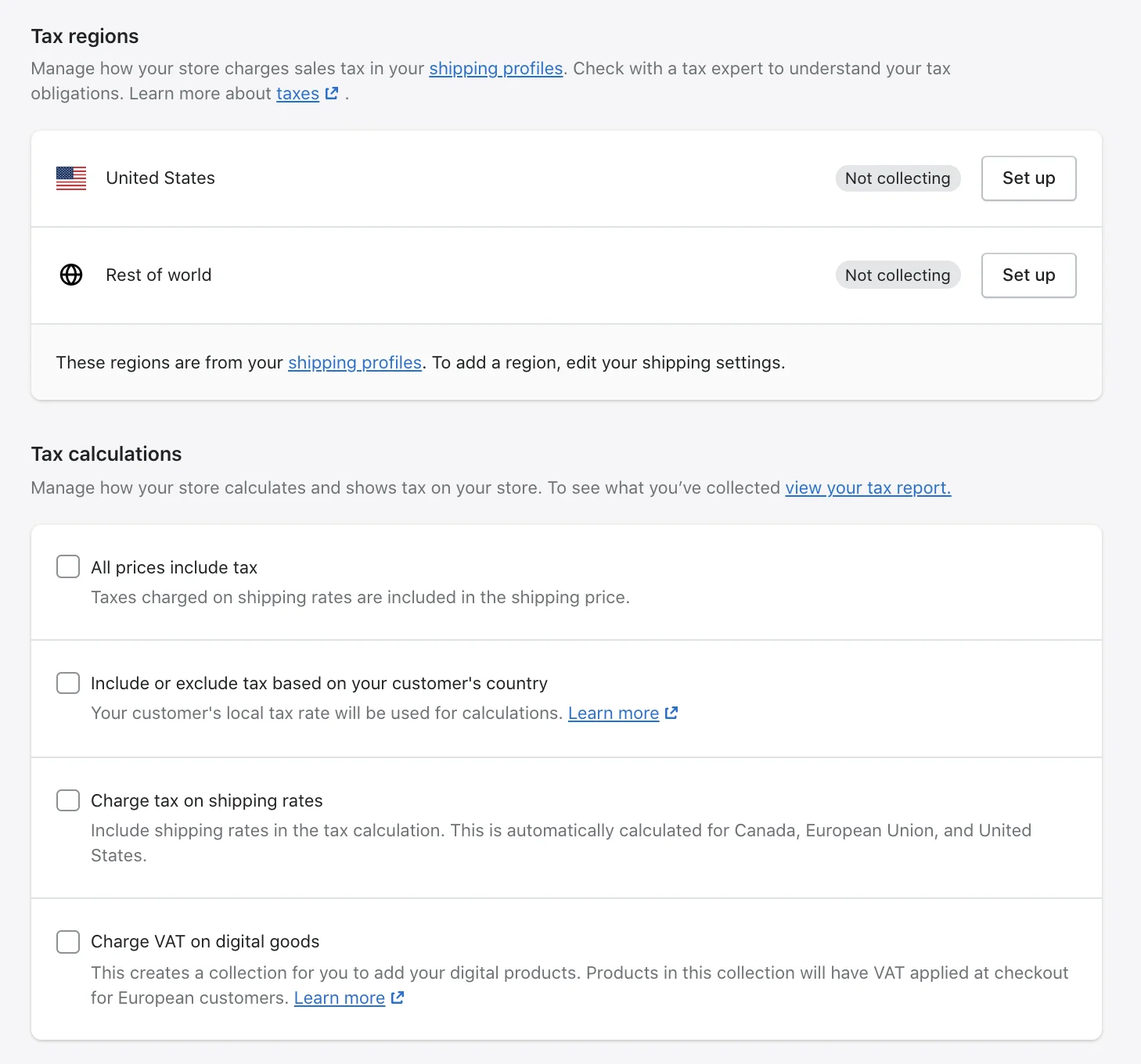

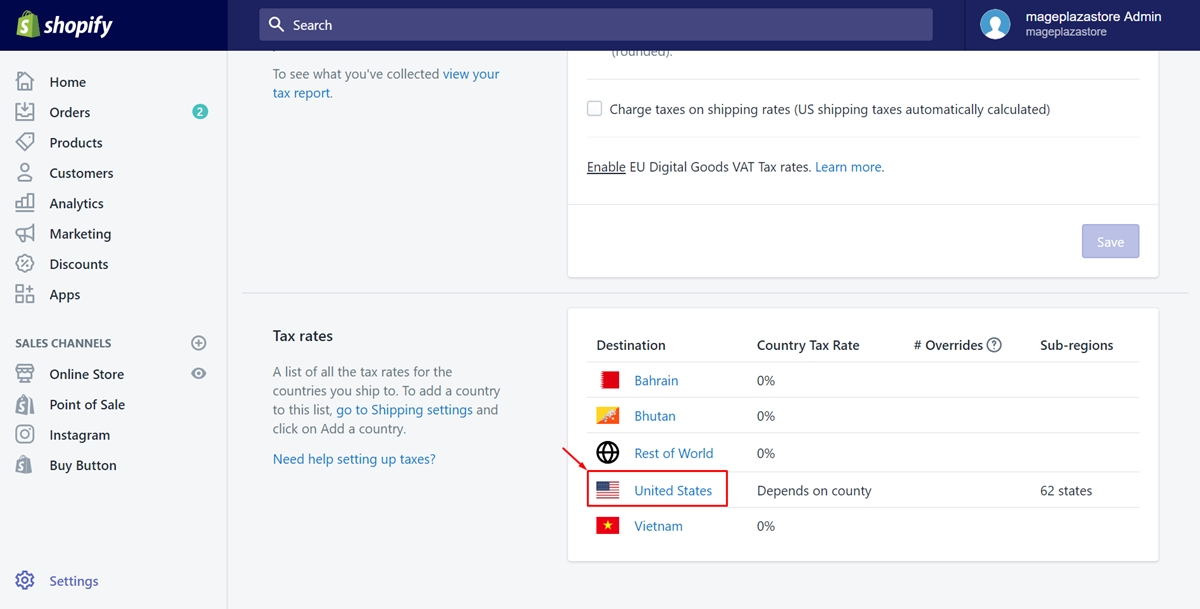

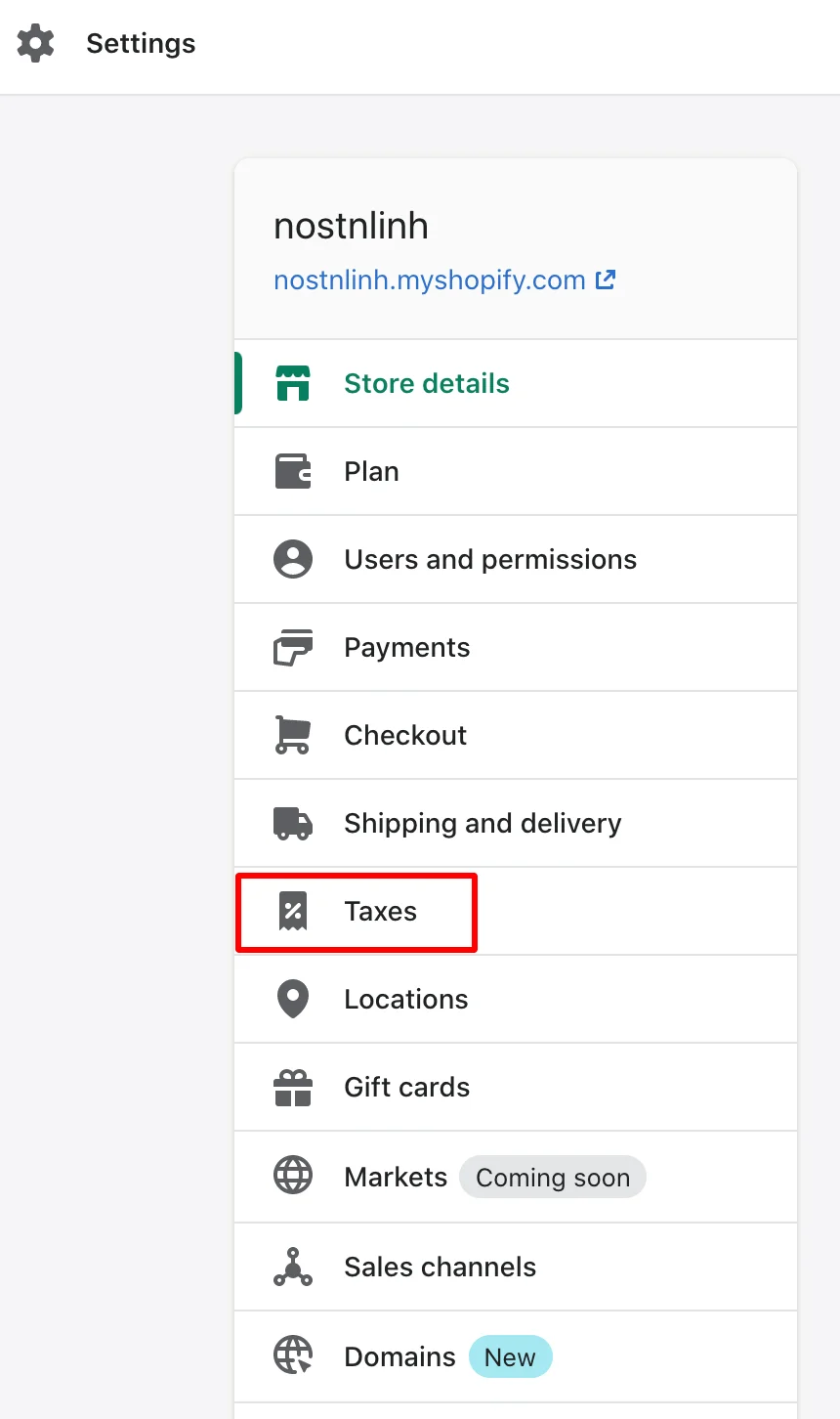

Lets plan your success. 1 Is it correct that there is no way to use the Shopify API to calculate sales tax. To turn on sales tax collection in Shopify simply go to Settings Taxes.

These will depend on the shipping zones you set up for your store and on the location of your business. Keep more profit while reducing risk and stress. Ideally Id like to enter line-items and customer address.

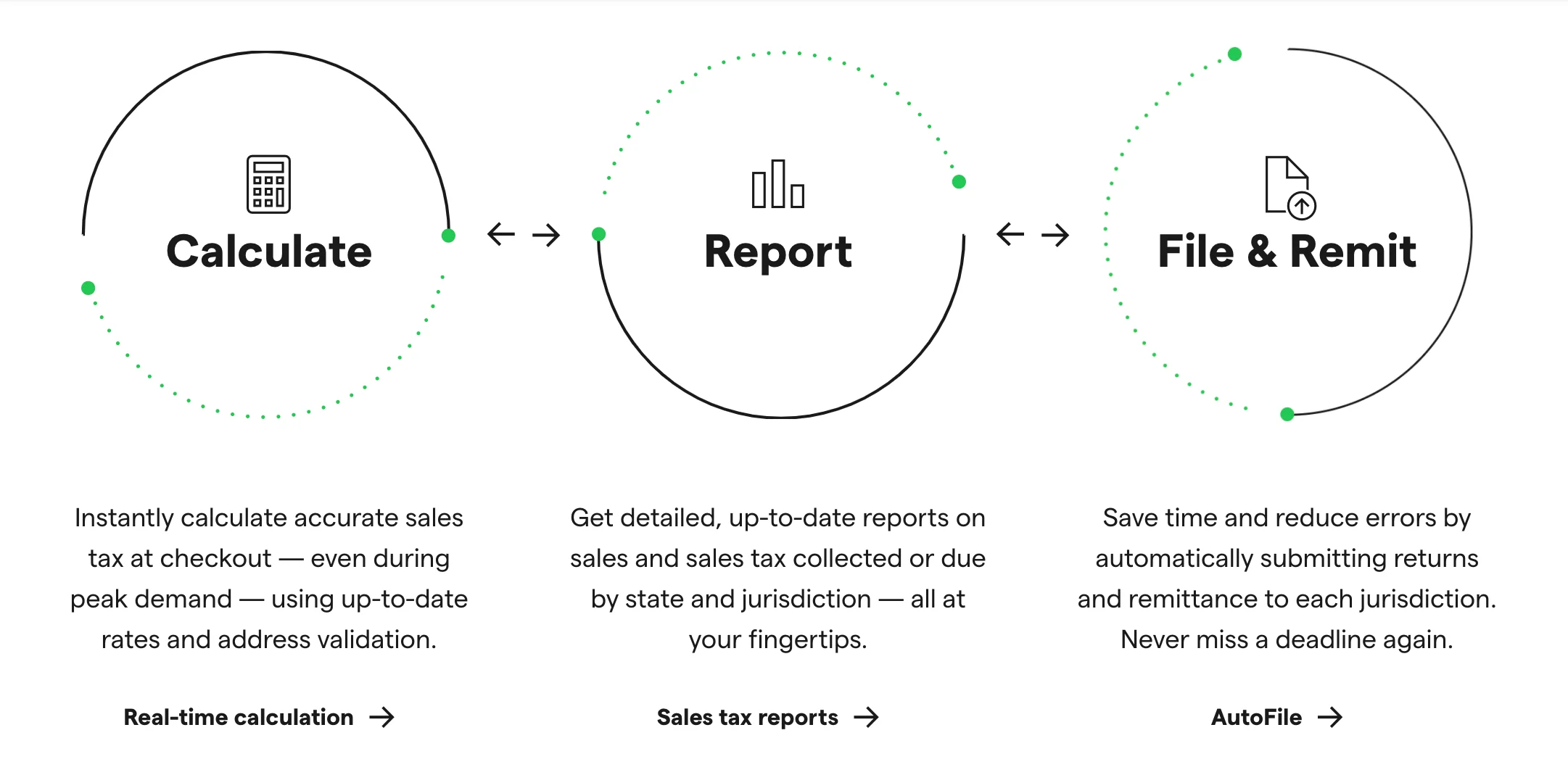

Apply the power of our sales tax calculator and automation tools to your website. The Shopify Tax Manual quickly and thoroughly walks you through setting up sales taxHere are a. What we can do is notify you when you have economic nexus in.

Ad Maximize your potential and grow your business with unlimited capital aligned to your plan. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Our innovative cloud-based sales tax calculation program AvaTax determines and calculates the latest rates based on location item legislative changes.

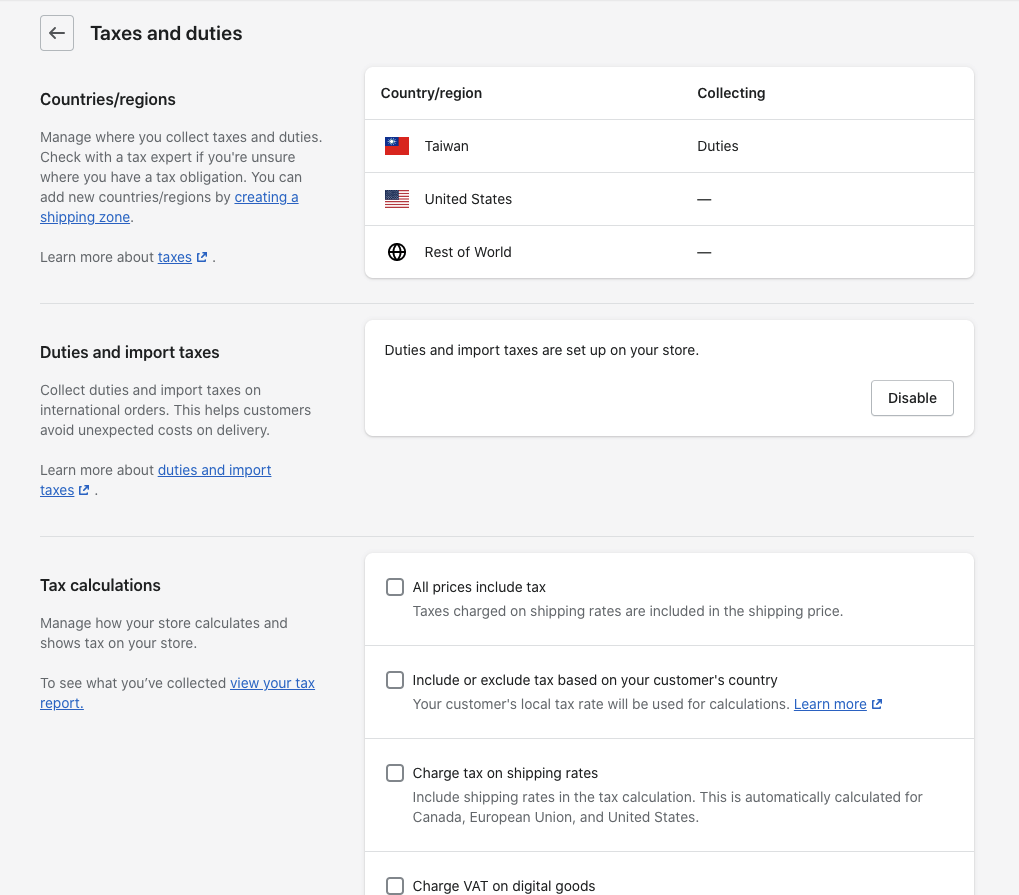

Unfortunately we can only read the data Shopify provide we cannot calculate the sale tax in this particular case. After youve determined where you need to charge tax in the United States you can set your Shopify store to automatically manage the tax rates used to calculate sales on taxes and set. The Shopify Carrier Calculated Shipping Rate API or CCS API - must be enabled for the app to return landed cost quotes.

Shopify uses default sales tax rates from around the world and theyre updated regularly.

How To Charge Shopify Sales Tax On Your Store Sep 2022

Shopify Duties And Taxes Support Shopify Markets Easyship Support

Shopify Hong Kong Merchants Now Get Free Fedex App Save Up To 75 On Shipping With New Fedex Woocommerce Business Account Printing Labels

How To Charge Shopify Sales Tax On Your Store Sep 2022

What Is The Formula For Tax Calculation On Shopify Orders Shopify Community

How To Charge Sales Tax In The Us 2022

How To Charge Sales Tax In The Us 2022

How To Set Up Automatic Tax Rates On Shopify

Shopify Calculating California Sales Tax Incorrectly Shopify Community

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

Configuring Tax Settings With The Shopify Checkout Integration Recharge

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

How To Charge Shopify Sales Tax On Your Store Sep 2022

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

Shopify S Sales Tax Liability And Nexus Dashboard Results Explained Taxvalet

How To Charge Shopify Sales Tax On Your Store Sep 2022

How To Charge Sales Tax In The Us 2022